Building Trust and Accountability with Mobile Driver’s License (mDL)

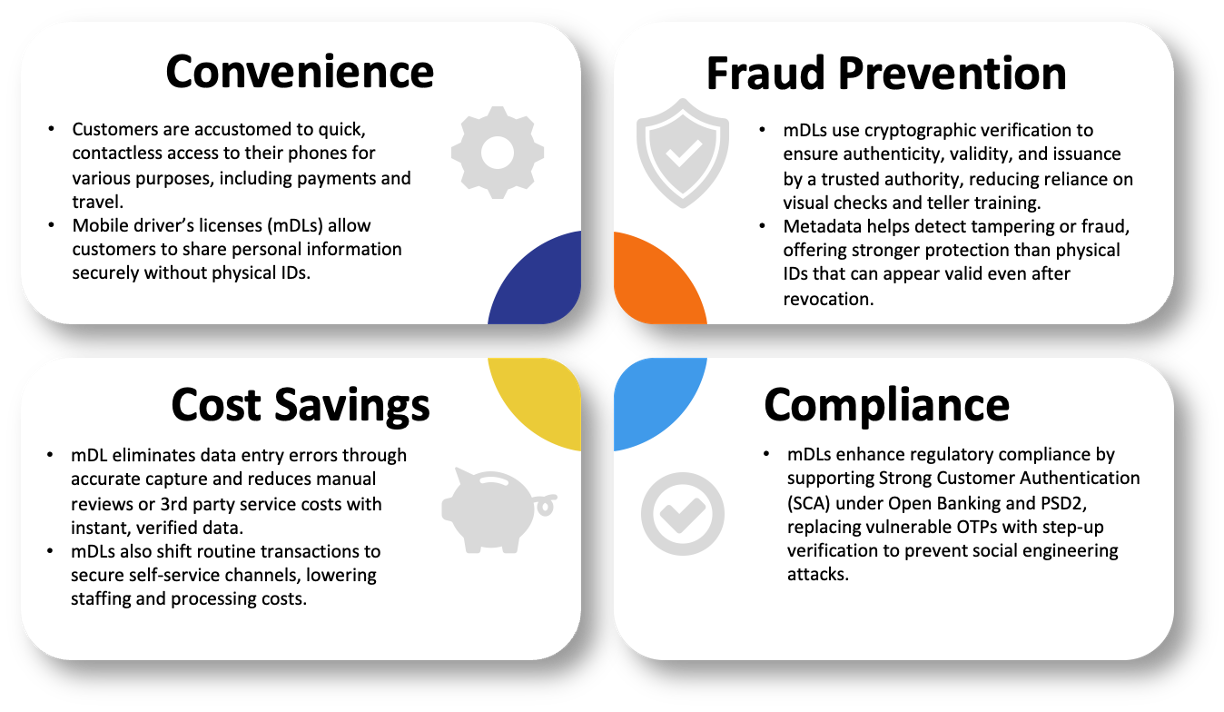

Financial institutions are at the forefront of the struggle of maintaining trust and accountability in digital interactions with customers. Identity fraud, through schemes such as account takeovers, fraudulent applications, social engineering, and synthetic identities have resulted in billions of dollars in losses impacting financial institutions. These challenges exist both for transactions made in person and online.

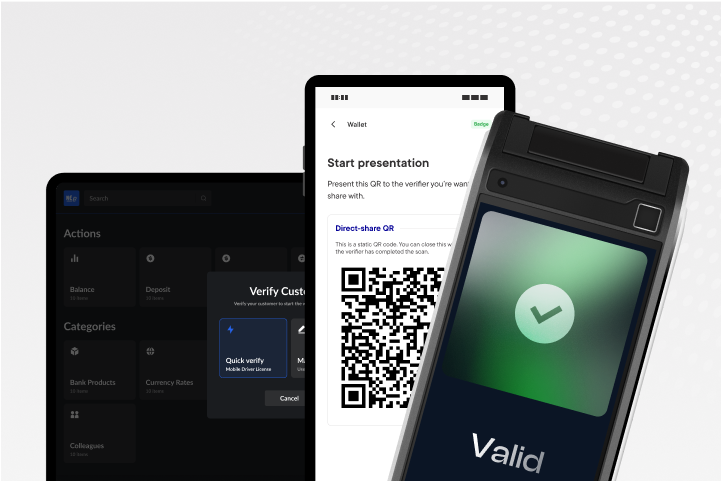

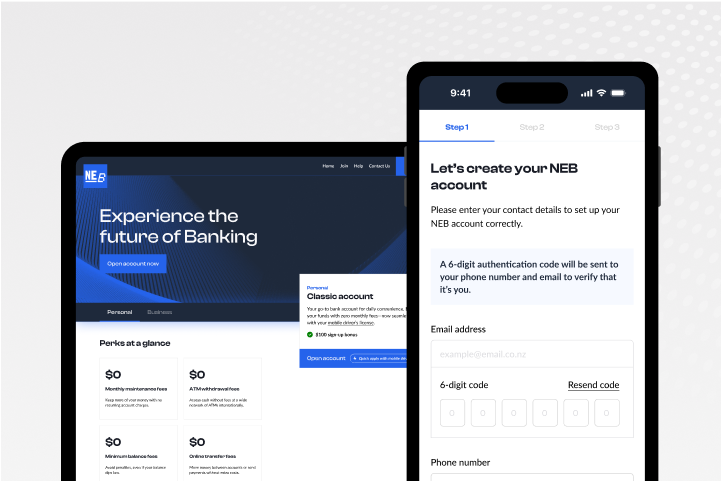

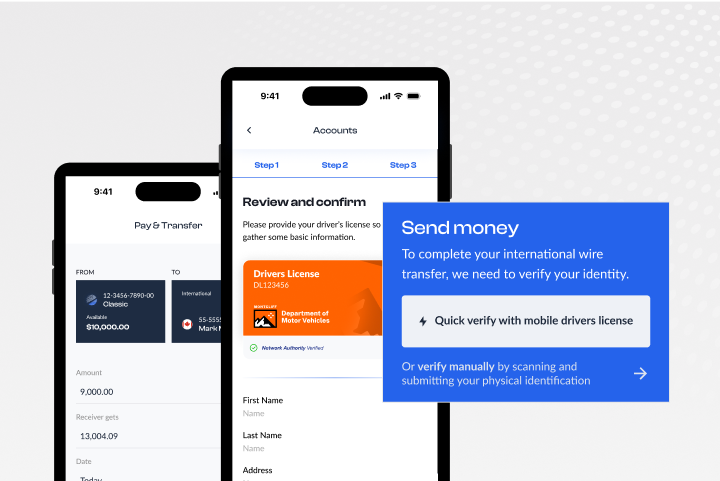

For the first time, financial institutions have access to a government-issued, cryptographically signed identity credential that ensures the authenticity of customer data at the moment of verification—whether online, in-branch, or via self-service channels. The Mobile Driver’s License (mDL) is a digitally verifiable, fraud-resistant identity document that eliminates reliance on scanned IDs, insecure OTPs, or physical document verification. Properly implemented, mDLs not only raise the level of assurance for high-risk transactions but also significantly enhance user experience across all banking touchpoints, streamlining everything from account onboarding to high-value transaction approvals.

Read our whitepaper: IAF Whitepaper – Building Trust and Accountability in Digital Financial Transactions with the Mobile Driver’s License (mDL)